The Canada Pension Fund Market size in terms of assets under management value is expected to grow from USD 4.11 trillion in 2024 to USD 5.51 trillion by 2029, at a CAGR of 6.05% during the forecast period (2024-2029).

Population growth in Canada is stable, with a fluctuation of 0.12% during the last year. The unemployment level in Canada has declined over the years, signifying continuous employment growth, and more people are eligible to receive a pension after retirement.

With the advent of COVID-19, a major focus of the government worldwide shifted towards social security. With these things in place, Canada's total assets of pension funds observed continuous growth during the pandemic.

During the previous year, of the total pension assets in Canada, 30% were allocated as equity, 28% in bonds, 38% in other investment plans, and 4% were kept as cash. Signifying only 1/3 of the amount has been invested in risky assets with high return possibilities makes Canada pension funds a safe plan for people to invest in, and with almost 7.5 million of the population in Canada coming under the age group of 65 years. Above, there is a requirement for a large amount to be devoted to pension funds.

As the inflation rate increases, people without access to a regular source of income become more vulnerable, causing a decline in purchasing power. To be saved from these scenarios, people are investing in the pension fund market to have a continuous source of income to buy commodities even after retirement.

A majority of pension funds exist for people who have retired from working and need a source of money for their retirement expenses. This demographic trend in the market creates an opportunity for Canada to grow its pension fund market.

This product will be delivered within 2 business days.

Population growth in Canada is stable, with a fluctuation of 0.12% during the last year. The unemployment level in Canada has declined over the years, signifying continuous employment growth, and more people are eligible to receive a pension after retirement.

With the advent of COVID-19, a major focus of the government worldwide shifted towards social security. With these things in place, Canada's total assets of pension funds observed continuous growth during the pandemic.

During the previous year, of the total pension assets in Canada, 30% were allocated as equity, 28% in bonds, 38% in other investment plans, and 4% were kept as cash. Signifying only 1/3 of the amount has been invested in risky assets with high return possibilities makes Canada pension funds a safe plan for people to invest in, and with almost 7.5 million of the population in Canada coming under the age group of 65 years. Above, there is a requirement for a large amount to be devoted to pension funds.

Canada Pension Fund Market Trends

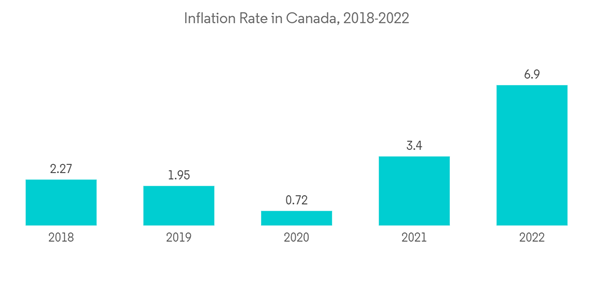

Increase in Inflation affecting Canada Pension funds Market

As people reach retirement age and have no income left, the value of their usual savings declines as the real value of commodities increases. The inflation rate in Canada is observing a continuous increase, reaching a level of 6.8% currently, with global market volatility and supply chain disruptions showing their effect.As the inflation rate increases, people without access to a regular source of income become more vulnerable, causing a decline in purchasing power. To be saved from these scenarios, people are investing in the pension fund market to have a continuous source of income to buy commodities even after retirement.

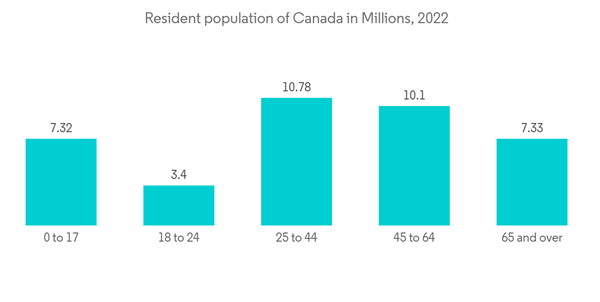

Change in demographics affecting Canada Pension Funds Market

The share of people aged over 65 years has observed a continuous increase, reaching a level of 18.83% currently. Other than this, Canada's maximum number of inhabitants is 45 to 64 years old, covering a population of almost 10.1 million people, signifying that a continuous growth in people over 65 will be increasing in the future.A majority of pension funds exist for people who have retired from working and need a source of money for their retirement expenses. This demographic trend in the market creates an opportunity for Canada to grow its pension fund market.

Canada Pension Fund Industry Overview

The average age of the Canadian population is 41 years old, signifying a continuous increase in population growth expected in the future. This creates opportunities for the pension fund market to expand its market share. Among the pension fund market in Canada, major firms and organizations operating in Canada include the Canada Pension Plan Investment Board, Caisse de Depot et Placement du Quebec, Ontario Teachers' Pension Plan, British Columbia Investment Management Corporation, Healthcare of Ontario Pension Plan, etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS AND INSIGHTS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- British Columbia Investment Management Corporation

- Caisse de depot et placement du Quebec

- Canada Pension Plan Investment Board

- Healthcare of Ontario Pension Plan

- Impax Asset Management

- Mawer Investment Management Ltd

- OMERS Retirement System

- Ontario Teacher's Pension Plan

- PSP Investment Board

- T Rowe Price

Methodology

LOADING...