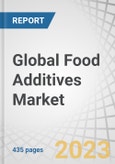

According to this report, the global food additives market is projected to reach USD 96.3 billion by 2028 from USD 73.4 billion by 2023, at a CAGR of 5.6% during the forecast period in terms of value. The longer shelf life, and ease of handling. The inherent stability of dry additives makes them ideal for storage, transportation, and incorporation into various food products. Manufacturers and consumers favor dry forms, such as powders or granules, for their convenience in measurement and consistent dispersion during food processing. Additionally, dry additives often exhibit enhanced stability against degradation factors like moisture and temperature, ensuring a longer shelf life compared to their liquid counterparts. This preference aligns with the food industry's demand for efficient, cost-effective solutions that maintain product quality. The dominance of dry forms reflects the industry's emphasis on practicality, efficiency, and versatility in the application of food additives across a wide range of products.

By application, Beverages is estimated to hold a significant market share during the forecast period

Beverages, encompassing a wide range from soft drinks to functional beverages, are integral to modern lifestyles. As consumers increasingly seek diverse and convenient beverage options, the demand for innovative and functional additives rises. This is particularly evident with the growing popularity of health and wellness trends, where consumers expect not only refreshing but also nutritious and enhanced beverages. The beverage sector's adaptability to incorporate different additives for flavor, color, stability, and nutritional benefits propels its significant market share. Additionally, the surge in demand for ready-to-drink and functional beverages amplifies the role of additives in meeting consumer expectations. As a result, the forecasted substantial market share for beverages underscores the pivotal role this application plays in driving the growth of the overall food additives market.

By source, the natural form is expected to dominate the market for Food additives

The dominance of natural sources in the food additives market is driven by a global shift towards cleaner and healthier food options. Consumers are increasingly seeking products with natural and recognizable ingredients, align with wellness trends. Natural sources, such as plant extracts, herbs, and spices, resonate with the demand for clean labels and reduced reliance on synthetic additives. Moreover, natural food additives often contribute to enhanced flavors, colors, and nutritional profiles without compromising on safety. The rising awareness of the potential health risks associated with artificial additives has propelled the demand for natural alternatives. This shift is not only consumer-driven but also influenced by regulatory efforts to encourage sustainable and transparent practices within the food industry. Consequently, the natural form's dominance reflects a broader commitment to health-conscious and environmentally friendly food choices.

Europe will significantly contribute towards market growth during the forecast period

Europe is poised to play a pivotal role in the growth of the food additives market throughout the forecast period for several reasons. The region's robust food and beverage industry, coupled with stringent quality and safety standards, positions it as a major contributor. Key players like Tate & Lyle (UK), BASF SE (Germany), and Kerry Group PLC (Ireland) have established a strong presence, leveraging innovations to meet evolving consumer demands. Moreover, the increasing consumer preference for clean labels and natural ingredients aligns with Europe's focus on sustainability and health-conscious choices. The demand for additives in diverse applications, including dairy, bakery, and beverages, is driven by a dynamic market landscape. The region's commitment to sustainability and preference for natural ingredients further aligns with the evolving market trends. As Europe continues to prioritize product quality, safety, and sustainability, it emerges as a key driver in shaping the trajectory of the food additives market during the forecast period.

Break-up of Primaries:

- By Company Type: Tier 1 - 40%, Tier 2 - 32%, and Tier 3 - 28%

- By Designation: C-level - 45%, D-level - 33%, and Others - 22%

- By Region: North America - 15%, Europe - 20%, Asia Pacific - 40%, South America - 12%, and RoW - 13%

Others include sales managers, territory managers, and product managers

Leading players profiled in this report:

- Cargill, Incorporated (US)

- BASF SE (Germany)

- ADM (US)

- IFF (US)

- Kerry Group PLC (Ireland)

- Ingredion Incorporated (US)

- Tate & Lyle (UK)

- Givaudan (Switzerland)

- Darling Ingredients Inc. (US)

- Chr. Hansen Holding A/S (Denmark)

- Novozymes (Denmark)

- Ashland (US)

- Cp Kelco (US)

- Glanbia PLC (Ireland)

- Sensient Technologies Corporation (US)

- Roquette Frères (France)

- Corbion (Netherlands)

- Foodchem International Corporation (China)

- Amano Enzyme Inc. (Japan)

- Enzyme Supplies (UK)

- ACE Ingredients Co. Ltd. (China)

- FDL LTD (UK)

- Mane (France)

- Nexira (France)

- Bell Flavors & Fragrances (US)

The study includes an in-depth competitive analysis of these key players in the Food additives market with their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the Food additives market on the basis of Type, Source, Form, Application, Functionality (qualitative), and Region. In terms of insights, this report has focused on various levels of analyses - the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global Food additives market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Food additives market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for clean-label, natural additives with transparent ingredient lists), restraints (Strict regulatory requirements and standards regarding the use of additives may limit their application in certain regions), opportunity (Strict regulatory requirements and standards regarding the use of additives may limit their application in certain regions), and challenges (Strict regulatory requirements and standards regarding the use of additives may limit their application in certain regions) influencing the growth of the Food additives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Food additives market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Food additives market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Food additives market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Cargill, Incorporated (US), BASF SE (Germany), ADM (US), IFF (US), Kerry Group PLC (Ireland), and Ingredion Incorporated (US), among others in the Food additives market strategies. The report also helps stakeholders understand the Food additives market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- Ace Ingredients Co. Ltd.

- ADM

- Amano Enzyme Inc.

- Ashland

- BASF SE

- Cargill, Incorporated

- CHR. Hansen A/S

- Corbion

- CP Kelco

- Darling Ingredients Inc.

- Enzyme Supplies

- Evonik Industries Ag

- FDL Ltd

- Foodchem International

- Givaduan

- Glanbia plc

- IFF

- Ingredion

- Kerry Group

- Mane

- Nexira

- Novozymes

- Roquette Freres

- Sensient Technologies

- Tate & Lyle

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 435 |

| Published | December 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 73.4 Billion |

| Forecasted Market Value ( USD | $ 96.3 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |