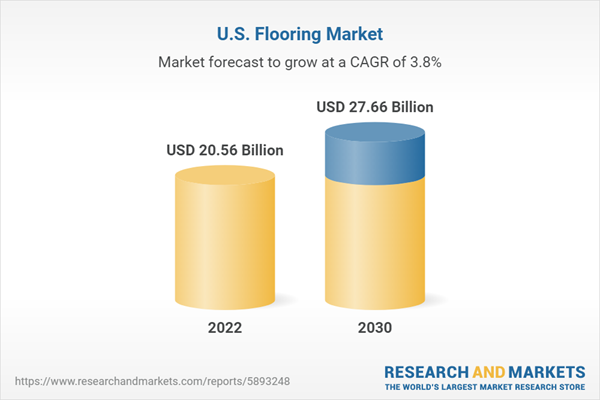

The U.S. flooring market size is expected to reach USD 27.66 billion by 2030. The market is expected to expand at a CAGR of 3.8% from 2023 to 2030. The growth of the market is owing to the growing construction industry around the world. The construction industry is growing due to a rise in public and private investments in infrastructure development activities.

The growth of the market is also anticipated to be driven by the rising demand for aesthetically appealing, durable flooring products. The surge in the construction of new residential buildings and the replacement of existing flooring with new ones is likely to drive the growth of the market. Commercial establishments aim at enhancing their interior and exterior designs and decor to provide a superior experience to consumers. This leads to surged demand for floorings such as wood, ceramic, luxury vinyl tiles, and carpets in the U.S.

Furthermore, increasing income levels, rapid urbanization, and increasing industrial output in the U.S. have driven the need for better infrastructure. The growth in construction spending coupled with government initiatives to reduce greenhouse gas emissions are expected to drive the demand for insulation, which in turn, is expected to propel the market growth in the U.S.

The development of green buildings is one of the major growth drivers of the flooring materials market. Furthermore, the construction of sustainable buildings with insulation is expected to provide favorable scope for the installation of lightweight and soft floor coverings such as ceramic tiles, wood, and carpets that emit low VOC content, have good thermal insulation, and provide acoustic comfort.

The growth in printing technologies, such as digital printing, aids manufacturers such as Tarkett, Mannington, Congoleum, and Shaw Industries to provide a variety of patterns along with realistic visuals, such as tiles and wood. Furthermore, the new material and coating technologies provide a wide range of patterns and colors, stain & chemical resistance, high wear resistance, and low maintenance.

The prices of floorings are governed by many factors, such as labor, raw material cost, transportation charges, and logistic charges. These factors account for major share of flooring products. Additionally, the utilization of special machineries and tools required for the production of floorings further adds to the overall cost of flooring products.

On account of fluctuations in raw material prices, several manufacturers have announced price increases for flooring products. In February 2022, Shaw Industries Group, Inc. announced an increase in residential laminates, hardwood, and glue-down LVT prices by 7%, effective from 4th April 2022. Engineered Floors increased prices of commercial carpets by 5-8% effective 4th April 2022. Furthermore, from 1st April 2022, the prices of laminates, hardwood, and resilient LVT flooring products of Mohawk Industries, Inc. have increased by 3-5%.

A large number of manufacturers are present at the country level. The market players focus mainly on innovation regarding the development of eco-friendly, cost-effective, durable, and low-maintenance flooring solutions for a wide range of applications. A majority of the companies also offer installation and post-installation services. Brand loyalty and brand recognition play an important role in driving a company’s market share. Therefore, competitive rivalry is anticipated to be high over the forecast period.

The growth of the market is also anticipated to be driven by the rising demand for aesthetically appealing, durable flooring products. The surge in the construction of new residential buildings and the replacement of existing flooring with new ones is likely to drive the growth of the market. Commercial establishments aim at enhancing their interior and exterior designs and decor to provide a superior experience to consumers. This leads to surged demand for floorings such as wood, ceramic, luxury vinyl tiles, and carpets in the U.S.

Furthermore, increasing income levels, rapid urbanization, and increasing industrial output in the U.S. have driven the need for better infrastructure. The growth in construction spending coupled with government initiatives to reduce greenhouse gas emissions are expected to drive the demand for insulation, which in turn, is expected to propel the market growth in the U.S.

The development of green buildings is one of the major growth drivers of the flooring materials market. Furthermore, the construction of sustainable buildings with insulation is expected to provide favorable scope for the installation of lightweight and soft floor coverings such as ceramic tiles, wood, and carpets that emit low VOC content, have good thermal insulation, and provide acoustic comfort.

The growth in printing technologies, such as digital printing, aids manufacturers such as Tarkett, Mannington, Congoleum, and Shaw Industries to provide a variety of patterns along with realistic visuals, such as tiles and wood. Furthermore, the new material and coating technologies provide a wide range of patterns and colors, stain & chemical resistance, high wear resistance, and low maintenance.

The prices of floorings are governed by many factors, such as labor, raw material cost, transportation charges, and logistic charges. These factors account for major share of flooring products. Additionally, the utilization of special machineries and tools required for the production of floorings further adds to the overall cost of flooring products.

On account of fluctuations in raw material prices, several manufacturers have announced price increases for flooring products. In February 2022, Shaw Industries Group, Inc. announced an increase in residential laminates, hardwood, and glue-down LVT prices by 7%, effective from 4th April 2022. Engineered Floors increased prices of commercial carpets by 5-8% effective 4th April 2022. Furthermore, from 1st April 2022, the prices of laminates, hardwood, and resilient LVT flooring products of Mohawk Industries, Inc. have increased by 3-5%.

A large number of manufacturers are present at the country level. The market players focus mainly on innovation regarding the development of eco-friendly, cost-effective, durable, and low-maintenance flooring solutions for a wide range of applications. A majority of the companies also offer installation and post-installation services. Brand loyalty and brand recognition play an important role in driving a company’s market share. Therefore, competitive rivalry is anticipated to be high over the forecast period.

U.S. Flooring Market Report Highlights

- Among products, ceramic tiles dominated the market in 2022. This segment of the market is projected to grow at a significant rate in terms of volume over the forecast period. High durability and rigidity, along with the ease of maintenance offered by ceramic tiles, lead to their surged adoption for developing flooring in the country. Moreover, the ease of installation offered by ceramic tiles and their availability in a wide range of colors, textures, and dimensions are also anticipated to surge their consumption in commercial and residential establishments in the U.S. in the coming years.

- Residential application segment led the market in 2022 by accounting for a volume share of 50.9% of the market in the same year. Wood flooring and carpets are widely used in residential applications owing to their durability and superior aesthetic appeal. The flourishing housing sector in the U.S., with required regulatory support in terms of permits of houses, is expected to fuel the demand for different flooring products in residential applications in the country over the forecast period.

- The market exhibits the presence of a large number of small-scale and well-established market players. These players have a robust distribution channel and geographic reach. They have also adopted the strategy of expansion to strengthen their presence in the market. However, fluctuations in raw material prices are expected to emerge as a key concern for the market players in the U.S.

Table of Contents

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. U.S. Flooring Market Variables, Trends & Scope

Chapter 4. U.S. Flooring Market: Product Estimates & Trend Analysis

Chapter 5. U.S. Flooring Market: End use Estimates & Trend Analysis

Chapter 6. Supplier Intelligence

Chapter 7. Competitive Landscape

List of Tables

List of Figures

Companies Mentioned

- Mohawk Industries, Inc.

- Tarkett

- Forbo Flooring North America

- Interface, Inc.

- EGGER Group

- LG Hausys, Ltd.

- Shaw Industries Group, Inc

- Mannington Mills, Inc.

- Armstrong Flooring

- Gerflor

- Polyflor Ltd.

- Porcelanosa

- Milliken & Company

- Beaulieu International Group

- Congoleum

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 94 |

| Published | September 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 20.56 Billion |

| Forecasted Market Value ( USD | $ 27.66 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 15 |