Increasing demand for sequencing at higher depth

This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

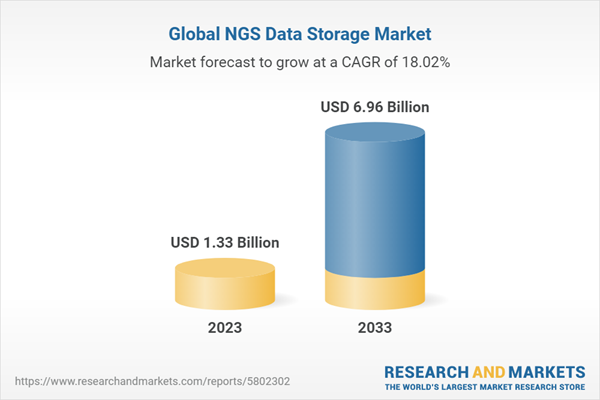

The global NGS data storage market is projected to reach $6.96 billion by 2033 from $1.13 billion in 2022, growing at a CAGR of 18.02% during the forecast period 2023-2033. The growth in the NGS data storage market is expected to be driven by the rising adoption of next-generation sequencing (NGS) tool in research laboratories that generates a huge amount of data that is stored and analyzed for actionable insights. Several companies have developed NGS informatics solutions to aid healthcare institutions and academic research centers.

Market Lifecycle Stage

NGS data is critical to researchers that offer storage solutions that are reliable while being easy to manage. Sequencing companies are adopting cloud-based storage solutions that offer several advantages, including accessibility, scalability, and cost-effectiveness. Cloud-based storage services are provided by various big IT vendors, such as Amazon Web Services, Google Cloud, and Microsoft Azure. These services offer pay-as-you-go models, which make it easier for researchers to manage costs based on their data storage needs.

Impact

NGS can be used to sequence the human genome and performed extensively in research laboratories during the COVID-19 pandemic. The technology generates an enormous amount of raw data that needs substantial amounts of computational processing to yield desired results. NGS also played a crucial role in advancing the research focused on tracing the origin of COVID-19. NGS bioinformatic pipeline was in practice during the pandemic that is defined as a series of data algorithms that are run to generate interpretable data. The technological methods of NGS are in high adoption in commercial laboratory processes and use inevitable variations in the software and computational tools. All NGS bioinformatics pipelines share several major features, including variant annotation sequence generation, variant identification, assembly and alignment, and variant visualization.

Impact of COVID-19

The SARS-CoV-2 virus changed multiple times during the pandemic through mutations and has a constantly evolving nature. Continuous monitoring of the viruses' genomes is vital for the various diagnostic assays in different locations. Several non-commercial protocols and commercial kits were made available for amplicon SARS-CoV-2 preparation, some of which were adapted by NGS platforms. Leading market players in the NGS data storage market that offer NGS data analysis solutions are undertaking strategic partnerships and collaborations to refine their product portfolios and maintain a strong global NGS data storage market.

There was the adoption of a bioinformatics platform by research laboratories during the pandemic, and the virus is still being sequenced even during the post-pandemic era. For example, in early 2023, the latest variant of XBB.1.5, which is a subvariant of Omicron, has become the most transmissible strain of the COVID-19 virus so far. Thus, the need to keep sequencing this virus is constant. The pandemic has also spurred genome sequencing committees around the world, which are sequencing infectious diseases like never before. An enormous amount of NGS data is being produced, which requires effective data analysis and data storage. The petabyte (PB) and zettabyte (ZB) are required to process and analyze data in the life sciences and pharmaceutical industry. The demand for data storage is anticipated to increase more in the future with the rapid usage of cloud-based solutions offered by companies to understand the mechanism of coronavirus to prevent future outbreaks.

Market Segmentation

Segmentation 1: by Read Length

- Short-read Length

- Long-read Length

Among the read length of the global NGS data storage market, the short-read length segment dominated in the year 2022. This is due to the rising adoption of short-read sequencing in research laboratories owing to its advantages, such as it is widely being used in diagnostic applications. The human genome is broken into small fragments, i.e., 50 to 300 bases, before it is sequenced. Short-read sequencing is cost-effective, accurate, and supported by a different range of data analysis pipelines and tools.

Segmentation 2: by Sourcing Type

- In-house NGS Data Storage

- Outsourced NGS Data Storage

Among the sourcing type of the global NGS data storage market, the in-house NGS data storage segment dominated in the year 2022, owing to increasing usage. In-house NGS data storage includes data analysis that involves those companies which are into the diagnosis of diseases. Such companies are carrying out NGS and their own data analysis using available software tools or servers or using available hardware and software resources. Companies operating in this segment have been increasing in the past few years.

Segmentation 3: by Offering

- Data Storage Solutions

- Data Analysis Services

- Other Offerings

Among the offerings type of the global NGS data storage market, data analysis services segment dominated in the year 2022. Bioinformaticians carry out data analysis services and the services can be customized depending on the customer’s requirements. Key aspects such as specific objectives, the approximate number of hours required for the project, and defined deliverables is estimated during the initial consultation by the bioinformaticians. Each data analysis service starts by consultation with an experienced NGS bioinformatics specialist in order to understand the customers requirements. Data analysis services deal with carrying out data analysis using software. For instance, Thermo Fisher Scientific, Inc. offers data analysis services using Torrent Suite Software. The company also offers a range of activities related to Ion AmpliSeq RNA or RNA-Seq data analysis and bioinformaticians guide their customer for these services.

Segmentation 4: by Application

- Oncology

- Infectious Diseases

- Rare Diseases

- Reproductive Health

- Central Nervous System (CNS)

- Other Applications

Among the applications of the global NGS data storage market, the oncology segment dominated in the year 2022. NGS technologies are efficient and accurate in detecting novel and rare somatic mutations. A variety of different types of cancers include bladder cancer, chronic lymphocytic, renal cell carcinoma, renal cell carcinoma, prostate cancer, small-cell lung cancer, and acute myelogenous. Cancer treatment is moving more toward targeted and personalized treatment. The five-year survival rate has improved significantly for many cancer types because of targeted therapies and immunotherapies.

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East

- Rest-of-the-World

Among the region of the global NGS data storage market, North America dominated in the year 2022. The North America NGS data storage market is foreseen to be majorly driven by the presence of cloud-based and on-premise software solutions offered by NGS data storage companies to process, and store, large genomic and NGS datasets in the cloud with built-in scalability, thereby enhancing the overall scope of the market. The U.S. dominated the North America region because of substantial investments by the U.S. government for the co-development of targeted therapeutics and molecular diagnostics, the presence of major market players in the country, and significant healthcare expenditure in the region.

Recent Developments in the Global NGS Data Storage Market

- In March 2023, Illumina, Inc. launched its first product based on its long-read technology. The technology has high-performance, long-read sequencing technology that offers an application for whole-genome sequencing (WGS) assay, i.e., Illumina Complete Long Read Prep, Human, which is compatible with Illumina NovaSeq X Plus, NovaSeq X, and NovaSeq 6000 Sequencing Systems.

- In March 2023, Illumina, Inc. launched 'Connected Insights Software,' a new cloud-based software that helps in the tertiary analysis of clinical data. The software is being used by researchers for tertiary analysis for oncology applications and for rare diseases in the future.

- In February 2023, Twist Bioscience gained early access to the Twist enhanced Whole Genome Sequencing (eWGS) solution targeted on non-human genomics applications at the Advances in Genome Biology and Technology (AGBT) 2023 General Meeting in Hollywood, Florida. eWGS is a novel solution that helps researchers to enable low-pass whole genome data together of selected regions in a cost-effective and high throughput workflow.

- In January 2023, QIAGEN N.V. introduced the QIAGEN Digital Insights (QDI), the bioinformatics business of QIAGEN, and enhanced QIAGEN CLC Genomics Workbench Premium for a $1.0 computing cost for 25 minutes. The product helps to remove the data-analysis bottleneck of NGS by adding game-changing analysis speed to analyze and interpret whole exome sequencing (WES), whole genome sequencing (WGS), and large panel sequencing data.

- In October 2022, BGI Australia’s lab received the National Association of Testing Authorities (NATA) to perform clinical Whole Exome Sequencing (WES) in Australia. The company paved the way for the global life sciences company to provide clinical sequencing services.

Demand - Drivers and Limitations

The following are the demand drivers for Global NGS Data Storage Market:

- Declining cost of cloud-based data storage solutions

- Increasing demand for sequencing at higher depth

- Growing number of population genomics studies and initiatives globally

- Rising adoption of cloud-based data storage solutions

The market is expected to face some limitations, too, due to the following challenges:

- Genomic data privacy and security concerns

- Increasing volume of data storage and its complexity

How can this report add value to an organization?

Innovation Strategy: Companies in the global NGS data storage market are involved in continuous innovation and strategy related to offering data analysis and data compression software solutions and services. For instance, In October 2021, VAST Data, Inc. introduced VASTOS version 4, its universal storage operating system, which has the capability to provide a range of enterprise security and management features designed to harden and simplify data management.

Growth/Marketing Strategy: Companies involved in the global NGS data storage market have received approval and certification from regulatory authorities. For instance, in October 2022, BGI Australia’s lab received the National Association of Testing Authorities (NATA) to perform clinical Whole Exome Sequencing (WES) in Australia. The company paved the way for the global life sciences company to provide clinical sequencing services. The MGI DNBSEQ-G400 platform that performs clinical WES and the procedures implemented by the technicians of MGI have qualified for NATA accreditation. NATA's certification for a laboratory is provided for storage and the process for data deletion, and these are a critical part of NATA’s certification.

Competitive Strategy: Key players in the global NGS data storage market are analyzed and profiled in the study to provide data storage solutions and services to their end users. Moreover, a detailed competitive benchmarking of the players operating in the global NGS data storage market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration. The leading top segment players include NGS data storage solutions and service providers. Also, other segments such as read length, sourcing type, workflow, application, and end-user in the market have been considered as part of the scope of the study.

Among the read length segment, the short-read length segment dominated in the year 2022 with a market share of 68.37%

Key Companies Profiled

- Agilent Technologies, Inc.

- BGI Group

- DNAnexus, Inc.

- Fabric Genomics, Inc.

- F. Hoffmann-La Roche Ltd. (Roche Molecular Systems, Inc.)

- Illumina, Inc.

- PerkinElmer Inc.

- PacBio.

- QIAGEN N.V.

- Qumulo, Inc.

- Thermo Fisher Scientific Inc.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- BGI Group

- DNAnexus, Inc.

- Fabric Genomics, Inc.

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- PerkinElmer Inc.

- PacBio.

- QIAGEN N.V.

- Qumulo, Inc.

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 201 |

| Published | May 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 1.33 Billion |

| Forecasted Market Value ( USD | $ 6.96 Billion |

| Compound Annual Growth Rate | 18.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |